mri cost with insurance

MRI cost with insurance and why it feels so confusing

If you are here, chances are a doctor has already said the words “You need an MRI,” and your next thought was not about magnets or scanners. It was about money. I know that feeling well. The first time I was told I needed an MRI, I nodded calmly in the exam room, then sat in my car and searched mri cost with insurance on my phone like my financial future depended on it.

This article exists for that exact moment.

In simple terms, mri cost with insurance usually ranges from very manageable to painfully surprising, depending on your plan, your deductible, and where you go. Many people pay between a modest copay and several hundred dollars, even with good medical imaging coverage. Others get hit with a bill that feels closer to the cost of MRI without insurance, especially when the deductible is not met.

I will walk you through the real numbers, the factors that change them, and the smartest ways I have learned to lower out of pocket MRI costs without playing insurance roulette.

How much does an MRI cost with insurance in real life

Let us start with the question everyone asks first.

How much does an MRI cost with insurance?

For most insured patients, the average cost of MRI after insurance falls somewhere between 50 and 500 dollars. That is a big range, and yes, it is frustrating. But there are reasons for it.

From my own experience and dozens of conversations with billing offices, here is what those numbers usually look like.

If your insurance deductible medical imaging requirement is already met, your health insurance copay MRI may be as low as 25 to 100 dollars. If your plan uses coinsurance, you might pay 10 to 30 percent of the negotiated rate.

If your deductible is not met, the MRI cost with deductible not met can jump quickly. In that case, it is common to see out of pocket MRI costs between 300 and 800 dollars, depending on the scan.

This is where many people panic and start scrolling through MRI cost with insurance Reddit threads, hoping someone else has cracked the code. I was one of them.

Why MRI scan cost with insurance varies so much

Insurance plan design matters more than you think

Not all healthcare plan radiology coverage works the same way. Some plans rely heavily on copays. Others push more cost onto coinsurance until the deductible is met.

When I switched from a traditional PPO to a high deductible plan, my MRI with insurance cost nearly doubled even though the scan itself did not change. That was my first real lesson in diagnostic scan pricing.

In network vs out of network facilities

This one is huge. An in network imaging center can cut your MRI scan cost with insurance in half compared to an out of network hospital.

Hospitals almost always charge more. Independent imaging centers are often the cheapest way to get MRI with insurance, and they usually provide the same technology and radiologist expertise.

Body part and scan complexity

A simple knee scan costs less than a spine or brain scan. A scan with contrast costs more than one without it.

Here are some typical examples people ask about.

Brain MRI cost with insurance often ranges from 200 to 600 dollars depending on contrast and location.

Lower back MRI cost with insurance can land between 250 and 700 dollars because spinal imaging is more complex.

MRI knee cost with insurance is often cheaper, sometimes closer to 150 to 400 dollars.

Hip MRI cost with insurance usually sits in the middle, commonly 200 to 500 dollars.

MRI cost with insurance by provider experience

MRI scan cost with insurance Blue Cross Blue Shield

Many readers specifically ask about MRI scan costs with insurance Blue Cross Blue Shield. In my experience and research, Blue Cross Blue Shield plans often have strong radiology insurance benefits when you stay in the network.

Typical mri scan cost with insurance blue cross blue shield ranges from 100 to 400 dollars out of pocket, depending on deductible status. Some plans require prior authorization, so skipping that step can lead to denied claims.

MRI cost with insurance Aetna

MRI cost with insurance Aetna plans tends to be similar, though Aetna often pushes patients toward freestanding imaging centers. That is not a bad thing. Those centers usually offer more affordable options.

Many Aetna members report average out of pocket MRI costs between 150 and 500 dollars when they follow network rules.

MRI with insurance vs without insurance

This comparison surprised me when I first learned it.

The cost of MRI without insurance can range from 400 to over 3000 dollars, depending on location and scan type. Hospitals sit at the high end of that range.

Here is the twist. Sometimes the cheapest way to get an MRI with insurance is actually to ask for a cash price and not use insurance at all. This usually happens when your deductible is high and not met.

I once paid less by asking for a self pay rate than I would have paid using insurance. It felt backwards, but it saved me hundreds.

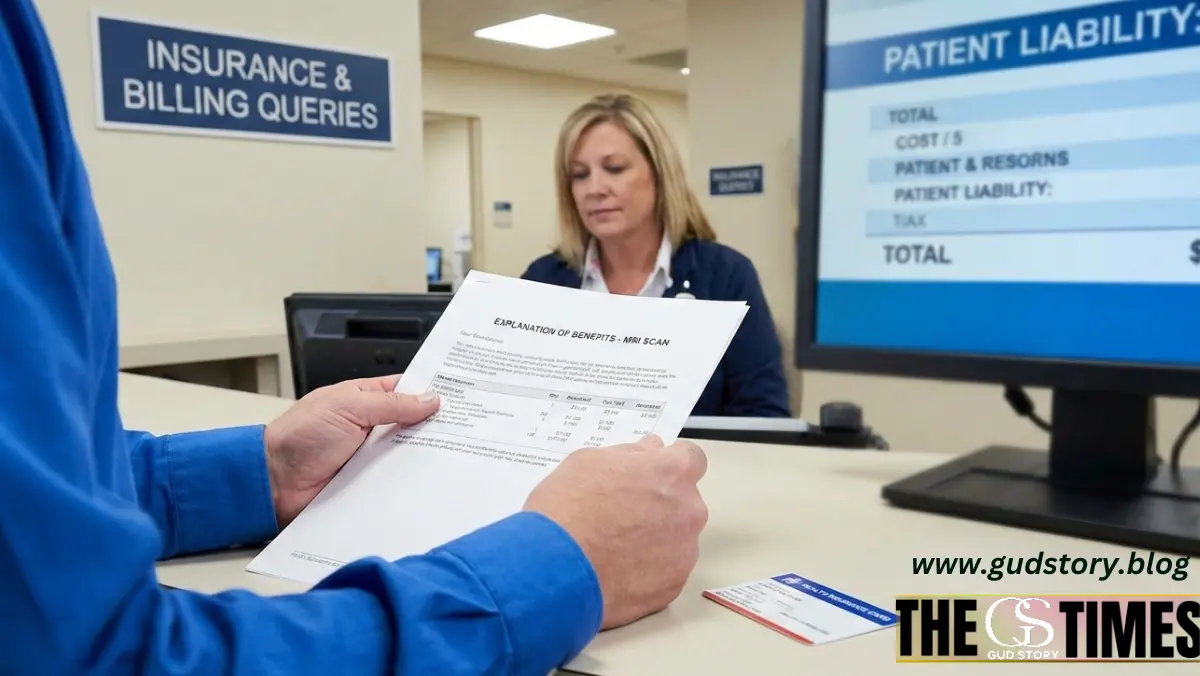

Hidden costs people do not expect

Radiologist reading fees

Some facilities bill separately for the scan and the radiologist interpretation. That can add 50 to 200 dollars if you are not careful.

Contrast agents

If your scan requires contrast, ask upfront. Contrast increases magnetic resonance imaging expenses and can change your final bill.

Prior authorization issues

One missed phone call can mean your insurance refuses to pay. Always confirm prior authorization before the scan.

How to lower MRI cost with insurance without losing your sanity

This is the part I wish someone had handed me years ago.

Choose imaging centers wisely

Freestanding imaging centers are almost always more affordable than hospitals. They specialize in MRI scan affordable options and work closely with insurers.

Ask for estimates using CPT codes

Call your insurance and ask what is the out of pocket cost for MRI using the specific billing code. This gives you real numbers, not guesses.

Ask about financial assistance

Many facilities offer medical imaging financial assistance, even for insured patients. It never hurts to ask.

Consider timing

If you are close to meeting your deductible, delaying the scan by a few weeks can drastically reduce what you pay.

Personal lessons from my own MRI journey

The first MRI I ever had felt overwhelming. I focused on the noise of the machine and the anxiety of the results. The bill arrived later, and that stress lingered longer.

Over time, I learned to treat MRI costs like any other major expense. Ask questions. Compare options. Do not assume the first price is the final one.

Understanding how medical imaging coverage works turned MRI scans from financial surprises into manageable decisions.

Frequently asked questions

Will my insurance cover an MRI

Most insurance plans cover MRI scans when they are medically necessary, but prior authorization is often required.

What is the average cost of MRI after insurance

The average cost of MRI after insurance typically falls between 50 and 500 dollars depending on deductible and plan structure.

Does insurance pay for MRI scans in full

Insurance may pay in full after your deductible is met, but many plans still require a copay or coinsurance.

How much does a brain MRI cost with insurance

How much does a brain MRI cost with insurance usually ranges from 200 to 600 dollars depending on contrast use and facility.

How to get insurance to cover MRI

Follow prior authorization rules, use in network facilities, and confirm medical necessity documentation with your doctor.